The original blog post in Japanese was published on June 30, 2022.

Many founders build their companies out of a passion to solve societal issues. Of those founders, many have tried to balance making an impact with success in the capital markets.

Unifa Inc., which aims to solve issues surrounding childcare and child rearing, is on its way to achieving both. The key to this is in integrating ESG practices, which we at MPower have worked on with the Unifa team.

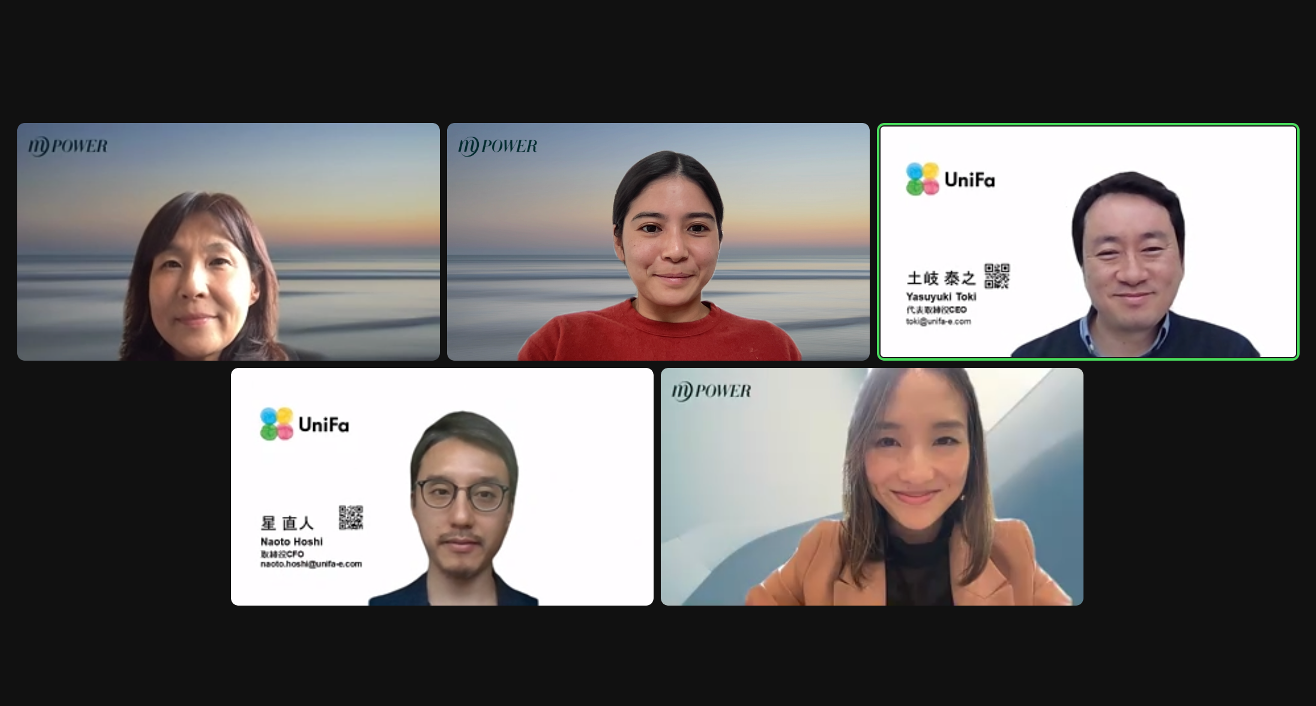

In an interview, we asked CEO and Representative Director Yasuyuki Toki and CFO and Director Naoto Hoshi about how Unifa views ESG and what role ESG integration plays in its strategy in the capital markets.

ESG as a means to articulate the medium- to long-term value of a business

Unifa has always been committed to contributing to the UN Sustainable Development Goals (SDGs), as publicly shared on the sustainability page on their website. Toki explains that Unifa chose to utilize ESG as an additional framework because “it was the most suitable framework to explain the purpose of Unifa’s business.”

“Fundamentally, Unifa is a startup that aims to solve issues related to childcare, and as we consider going public in the future, we felt that we needed to articulate our purpose to the capital markets. Different people define and measure ‘solving societal issues’ in different ways, so using the ESG as a framework, we are able to clearly explain the medium- to long-term value we bring to society as a whole, including financial returns.”

Hoshi adds, “in the capital markets, ESG is the de facto standard over SDGs. Each framework has its own pros and cons, so one is not necessarily better than the other. However, when considering dialogue with the capital markets, we believe that using ESG is an effective way to begin.”

Put simply, for Unifa, ESG is the best means of achieving accountability in the capital markets.

A focus on making employees happy

Aiming to “enrich families through the power of technology,” Unifa provides information and communications technology (ICT) services to childcare facilities and promotes the concept of “smart childcare centers, preschools, and kindergartens.”

Within ESG, Unifa’s primary focus is in the area of S (Social). In particular, Unifa’s priority is to solve the labor shortage at childcare facilities and reduce the burden of childcare-related work. The company hopes to enable women to become more active in society and improve the quality of care and education for children.

Internally, Unifa has strategically created a strong HR system, including a benefits program and recruitment process, believing that “we are a company that creates infrastructure to make families happy, and it would mean nothing unless our employees and their families are happy.” Currently, in addition to further increasing the ratio of female leaders, Unifa is also focusing on promoting the use of family leave, including for men.

Establishing good governance from an early stage

In addition to the Social factors, Governance (G) is also a key area of focus for Unifa. Hoshi says, “startups are generally owned by the founders, so it is extremely important to show the capital markets that the company has a solid governance system.”

As a concrete action for G, the company announced its intention to become a company with an audit committee at the same time as the announcement of the Series D fundraise in which MPower participated. Furthermore, the company has spent about two years recruiting outside directors–Shinobu Matsui of Uzabase and Hitomi Iwase of Nishimura & Asahi–who bring “two well-rounded perspectives” and have a good fit with the company’s culture.

These efforts are on par with those of large corporations, which is uncommon for a startup. However, Hoshi points out, “by doing what is right even though we are unlisted, rather than doing it because we are required to as a listed company, we can show with our actions the direction we aim for as a company.”

Hoshi continues, “in the same way that it is better to learn good habits from an early age, if a start-up company engages in ESG activities early, it can ingrain good standards as part of its identity. However, while it’s important to have this mindset, startups don’t have to match the level of large or public companies from the start. The key is to do what you can in a step-by-step manner.”

ESG helps clarify Unifa’s purpose and philosophy

Through these ESG initiatives, Toki says that he has gained a new awareness of the company’s purpose.

“We have been sharing our quantitative business metrics until now, but we have not quite been able to articulate our deeper thinking on the business. ESG has enabled us to differentiate ourselves from other companies and to proactively share our most important values. By thinking about actions to further the impact behind these values, we are now able to take the next steps and reflect them in the numbers.”

Including the perspective of children among their S-related materialities is unique to Unifa. Toki says, “while we continue to work on directly connecting this perspective to products and services, we have deepened our thinking behind the consideration of children’s rights, how to preserve children’s memories, and how to utilize data to do so. I believe that this is part of our core and philosophy that we want to maintain.”

Hoshi adds, “what is important for a startup is to find its uniqueness and the source of its passion. ESG practices can be a catalyst for finding that, which is why startups ought to consider integrating ESG as soon as possible.”

ESG: a common language with the capital markets

Through ESG integration, Unifa has recommitted to its purpose, identified priority issues, and taken action for growth. Toki emphasizes that “it is important to build our business, organization, and finances based on a common language of ESG, in order to solve societal issues while keeping the capital markets on our side.”

“The management’s role is to do what it takes to increase the value of their company, especially if it enables them to solve societal challenges. If ESG is a useful common language of the capital markets, there is no reason not to take advantage of it.”

Yasuyuki Toki, CEO and Representative Director, Unifa Inc.

ESG initiatives at Unifa are summarized on the “Sustainability and ESG” page of the company’s website. We invite you to learn more about the key issues and processes in each area.

______________________________________

Unifa’s ESG-related pages (links in Japanese only):